Intelligent Credit Risk Management

Proactively manage your exposure with continuous credit risk alerts from banks, bureaus and your own A/R data. Right-size riskier accounts, and identify growth opportunities in your customer base.

Proactive

Stay on top of changing risk with an action queue organized by severity of change and signal

Contextual

View signals across bureaus, banks, references and your own A/R data to get the full picture

Automated

Replace tedious scheduled reviews with auto-refreshed insights and alerts

Credit Risk Dashboard

Prioritize the biggest risks and opportunities across an array of signals with an intuitive work queue, sorted by magnitude of signal change.

Monitor changes in connected accounts:

- Month-over-month average bank balance

- 6-month average balance

- Non-sufficient funds notice

Track changes in:

- Risk score percentile

- Credit risk score

- International credit score

Alerts against:

- Federal tax lien filings

- State tax lien filings

- Legal filings and bankruptcies

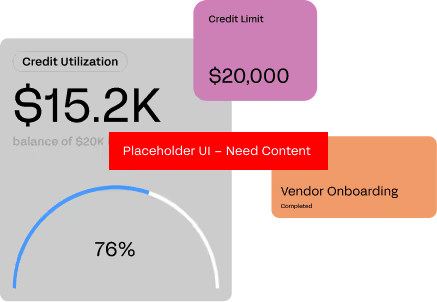

A/R Intelligence

Complete your customers’ risk profile by pulling in their spend and payment behavior alongside credit risk insights. Get ahead of order holds by expanding the lines of growing, responsible customers. Reduce losses and improve cash flow by staying on top of accounts with increasing DSO.

- Track spend against allocated credit

- Reallocate your exposure from low-spend/high-risk accounts

- Identify sales opportunities for underutilized credit lines

- Monitor DSO trends per customer

- Manage the health of customer portfolio with overall DSO

- Drill into aging to action against overdue accounts