Intuitive, High-Converting Customer Onboarding

Get to trusted partnerships faster with application flows tailored specifically for your brand and customer. Real-time verifications and business intelligence means you’re ready to review as your customer clicks “Submit.”

Flexible

Create beautiful, branded applications tailored to all your customers, regions, and product lines.

Intuitive

Win more customers by offering the fastest and easiest onboarding, designed for devices of all sizes.

Connected

Get your customers purchase-ready faster with integrated insights and one-click account creation in your ERP.

Self-serve / Real-time

With Nuvo onboarding, customers synchronously verify their information, connect their bank, and confirm their reference contacts so you’re decision-ready, instantly. Review integrated bureau reports, detailed financial insights and auto-collected trade references and send approved customers to your ERP in minutes.

- Unlimited flows with configurable branding, requirements, and custom questions. Read more about digital credit applications.

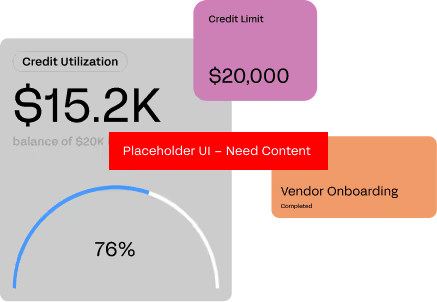

- Shared dashboard view for Finance, Sales, and your Customers to track credit utilization, spend and payment behavior

- Built-in workflows to assign reviewers, request changes, refresh compliance documents, and trigger credit reviews

- Portfolio of integrated insights to build your decisioning scorecard

- Auto-matched credit reports pulled at application submission

- Direct integration with 16,000+ banks to pull live bank balances and liabilities

- Trade reference automation to request, verify and collect trusted references

- Originate new customers in your ERP directly in Nuvo

- Track customer payment trends, credit utilization and DSO alongside credit insights

- Identify opportunities to right-size existing accounts

Verification / Fraud Protection

B2B Fraud is on the rise, with 70% of businesses reporting increased fraud losses in recent years. (Experian, 2023). Nuvo’s fraud suite analyzes an array of signals to help you protect your business.

Customers confirm their emails with one-time passcodes, and Nuvo analyzes domains for risk signals such as age, traffic, and blacklisting. Business or delivery addresses are matched to the business to prevent impersonation.

- Web domain scoring calculated against age, traffic, and blacklisting

- Verified ownership of applicant email via one-time passcodes

- Integrations to the IRS and Secretary of State verify every trading partner’s profile with authoritative sources to ensure clean data in your systems and enforceable legal agreements.

- EIN/TID and Legal Name verification with IRS database

- Auto-matched Secretary of State records across all states

- Business address matching against Google Places business listings

- Address validation and address type (residential vs. commercial)

Owners, officers and signatories personal identities are checked against multiple sources to ensure you know your customer.

- Legal name, tax ID, date of birth, residential address checked against authoritative databases

- Photo ID verification