The Ultimate Resource: Business Credit Application Guide 2025 [Free Template Included]

What Is a Business Credit Application?

Credit applications act as a background check for businesses to determine the level of risk giving an advance to a customer might pose. If a business provides a customer with a product before performing a credit check or receiving payment, then they expose themselves to the possibility of severe interruptions to their cash flow if the customer breaks their agreement.

A business credit application can make it easy to collect all the information you need to properly gauge the risk a specific customer poses. It can also help you determine how much credit is appropriate at that time.

B2B Credit Applications vs. B2C Credit Applications

While granting a line of credit for a business-to-business (B2B) relationship is similar to business-to-consumer (B2C), what they’re looking for differs. Typically, when a consumer needs to buy something on credit, it’s for a single item that is slightly more costly than their typical expenses, like jewelry or workout equipment. Since B2C credit transactions are typically non-recurring for a high volume of customers, it makes sense to have a bank handle the requests.

Applying for business credit from a vendor is often done with the intention of building a long-term professional relationship. The customer often intends to use what they purchased on credit to help them make their own sale. They then use the profits from the sale to pay off the advanced credit. These purchases can quickly accrue to be worth hundreds of thousands of dollars. The stakes are much higher than B2C and, as a result, the credit check is more complicated.

Secured vs. Unsecured Credit

There are two approaches a business can take when approving business credit applications: secured and unsecured. A secured line of credit requires the customer to put up an asset as collateral. If the customer fails to honor the agreement, the vendor can seize the asset in lieu of payment.

An unsecured line of credit (ULOC) requires no form of collateral and is based on the customer’s credit history. If they are seen as low risk, then they are more likely to be approved for an unsecured line of credit. This is usually determined by the industry the business operates in and their own internal policies.

What’s Included on Business Credit Applications?

For business credit applications to accurately carry out their function, certain information should always be included:

- Applicant’s contact information: This includes the name of the business, billing/shipping addresses, email and phone numbers, and other relevant details.

- Ownership information: Knowing who the owners and principals of the company are can give added credibility to the company.

- Trade reference information: This includes contact information for someone the applicant has a working relationship with and who can provide insight into the customer’s credit history.

- Annual sales: This data is used to get an idea of the applicant’s income to help find a reasonable credit limit.

- Bank information: This includes account numbers and bank contact details to verify the applicant’s average balance.

- Amount of credit requested: The request is compared against their existing financial records to determine if it is reasonable.

- Date of application: The day the request was submitted can help determine when the term should begin.

A business credit application can be tailored to the specifics of any industry. Here is a business credit application template you can use in your operations or as inspiration for creating your own.

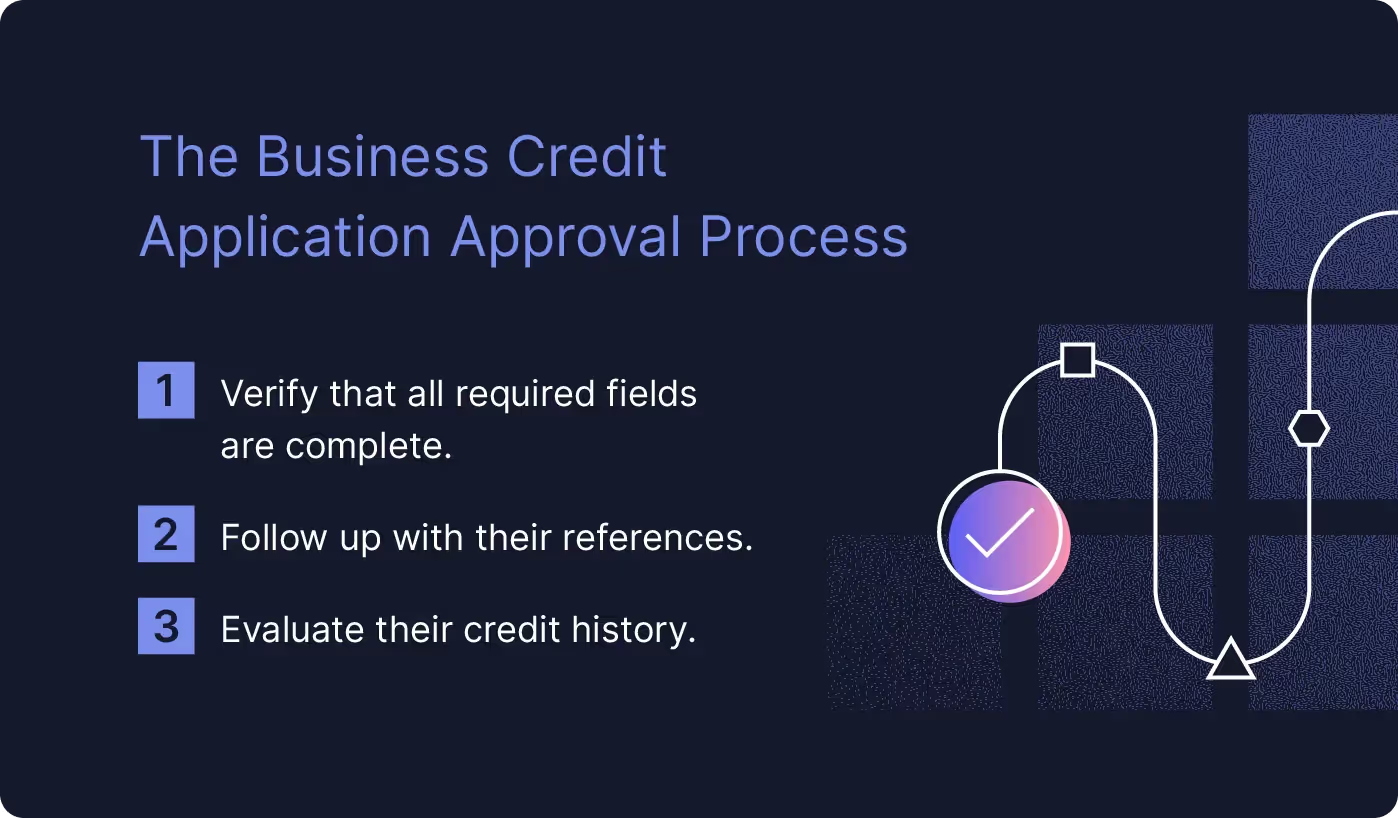

Steps To Approve a Business Credit Application

After receiving a customer’s credit application form, you’ll need to analyze their information to determine if they qualify for a line of credit and how much that might be. For help with the approval process, apply the following steps.

1. Verify All Required Fields

The first step in reviewing your applicant’s business credit application is to ensure it has been filled out completely and correctly. If the credit application was not clear regarding which fields were optional and which were required, it’s possible the applicant left some blank. There’s also the possibility that the applicant entered their information incorrectly if they misunderstood what was being asked. To avoid this, clearly phrase all instructions on the form so the process won’t be unnecessarily prolonged.

2. Cross-check References

Following up with the applicant’s trade references is an important step in the vetting process. These are the people who are vouching for the applicant based on their past working relationship, helping you anticipate how they will act if given a line of credit. In some instances, an applicant may cite fake references with the hope that they won’t be contacted. Make a point to contact these people early on to avoid potential fraud.

3. Evaluate Credit History

An applicant’s credit report can generally be obtained from organizations like the National Association of Credit Management or Creditsafe. Use these results to inform your decision on whether or not the applicant is eligible for a line of credit and, if they are, for how much.

You may find that a credit report lacks details about a specific company’s financial history, sometimes only reporting on a small fraction of their spending history. To work around this issue, look for a service like Nuvo that offers instant digital bank references and credit reports on the principals of the company to get a better picture of their spending habits.